#FORMULA OPERATING INCOME BLUETOOTH#

The marketing hits all targeted demographics increasing the demand from 60 to 100 Bluetooth speakers weekly. Step costs are a consistent expense for a given activity level, but the number increases or decreases after crossing a specific threshold.įor example, say a company produced 60 Bluetooth speakers a week with twenty technicians and two supervisors with wages and benefits equaling $70,000 per shift. Operating expenses, or OPEX, do not include SG&A (selling, general, and administrative expenses), depreciation, or amortization. Allocated funding for research and development.

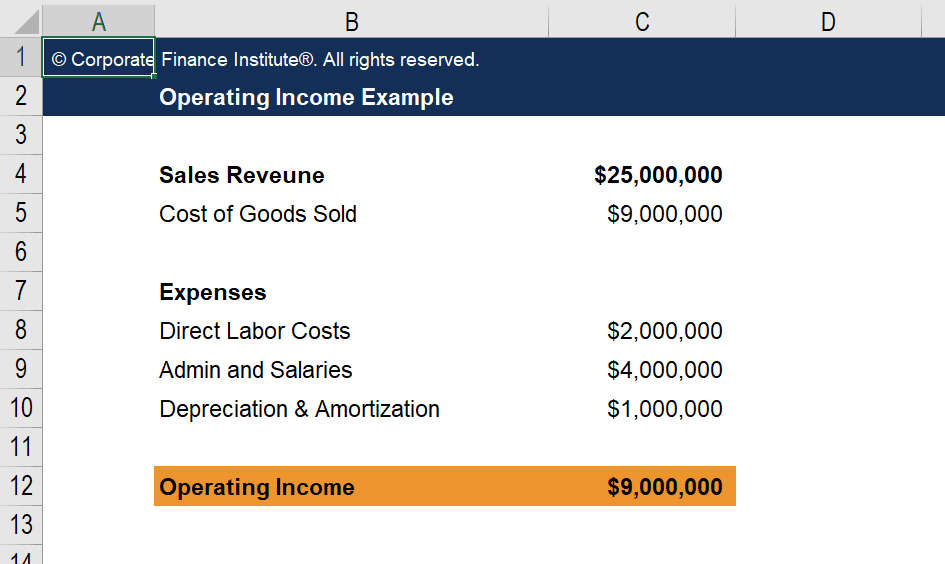

When your operational expenses get out of hand, your burn rate can multiply twice as fast. Spending money to make money shouldn’t cast a veil on proficient cash flow budgeting, though. Operational expenses are an unavoidable part of running a functional business. What Is Considered An Operational Expense? $14.2 billion - $3.7 million = $10.5 billionĭepending on the month’s gross income, fluctuating operational expenses, and miscellaneous income, the difference between operating income and EBIT can be tremendous or non-existent. Gross Income - Operating Expenses = Operating Incomeįor example, company X had a stellar month with a gross income of $14.2 billion with operating expenses totaling $3.7 million, leaving the company with $10.5 billion in operating income. You can calculate operating income by subtracting operation-related expenses from gross income (or gross profit). Operating income statements pinpoint where the issues lie. Operating income breaks apart the operational process of a business from other expenditures.Ī profitable business can go under when operational expenses override net income. It may seem like an odd practice to include a total profit without subtracting other expenses or adding additional income. Investors and founders can look at these numbers in contrast with direct market competition to see if any improvements need made.

Income from operations is the metric investors use to decipher a company’s overall management of cash flow and budgeting. To determine profitability, you need accurate numbers to input into the formula, which we will describe below.

Calculating operating income is one of the best ways to assess a company’s profitability and operational efficiency and a metric that investors will want to see.Ī high operating income shows profitability, while a low or decreasing number means there are problems in operational expenses. Profitability is an important metric to measure it shows that your company is heading in the right direction. There is an abundance of financial records founders must understand and monitor to see their company’s financial health.

0 kommentar(er)

0 kommentar(er)